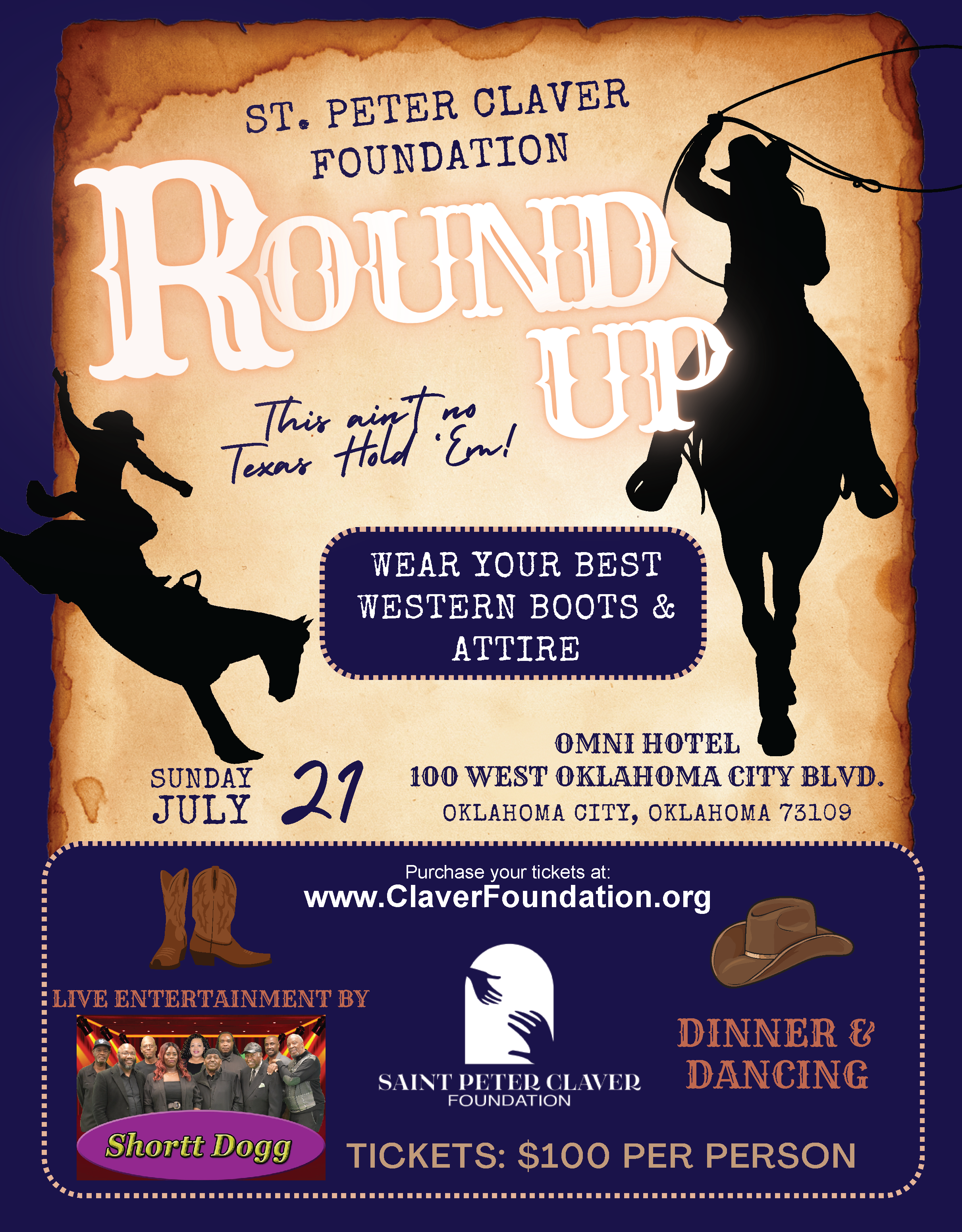

The Enduring Call to Love

Help the Saint Peter Claver Foundation raise awareness and combat issues plaguing our communities: Black Lives Matter - Dignity of Black Lives, Criminal Justice Reform, Domestic Violence, Human Trafficking, and Racism by pitching in your contribution towards our fight for justice!